Avoiding the Next JPEX: How to Choose a Safe Exchange?

The JPEX exchange has been exposed for its inability to withdraw funds and false licensing claims, earning it the title of “the biggest financial fraud case in history” by Hong Kong media! Even now, JEPX users are still unable to withdraw their cryptocurrencies, leading to many Taiwanese people becoming victims.

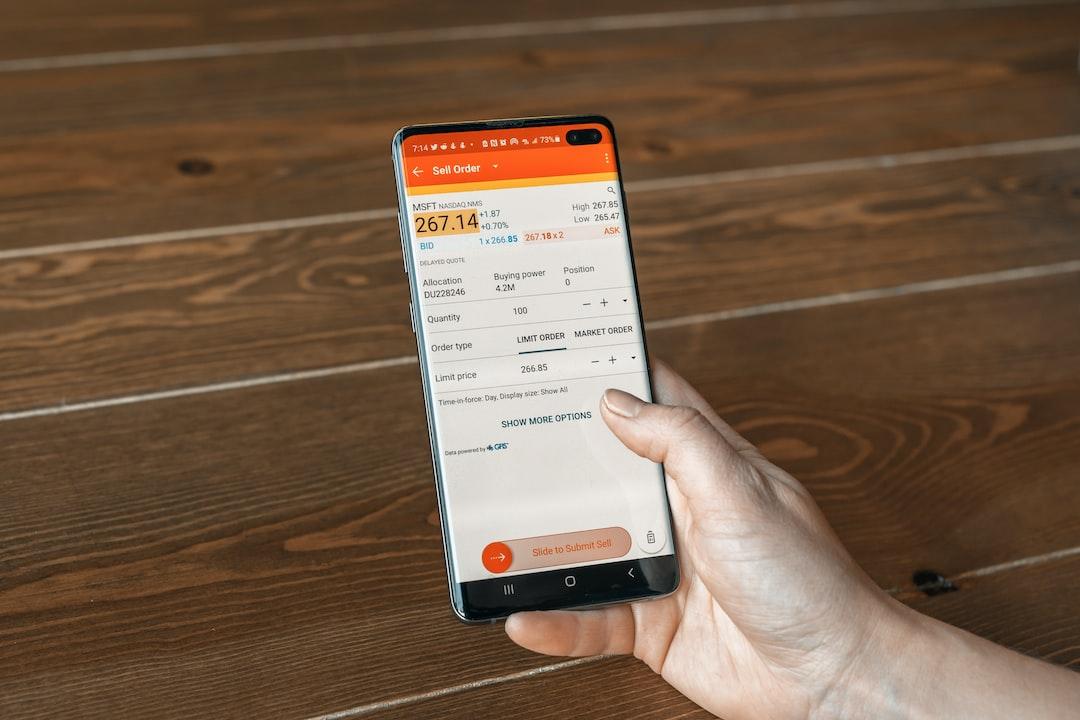

For cryptocurrency investment newcomers, choosing a reliable and secure platform in the rampant world of scams is indeed a major challenge. Especially since cryptocurrencies have not yet received comprehensive government regulation, investors need to be cautious and spend more time and effort confirming the safety of their chosen exchange to ensure it is trustworthy.

Although many people tend to consider platforms that offer attractive community activities, registration perks, or a wide selection of coins when choosing an exchange, what truly matters is ensuring that their assets are properly safeguarded within it.

This article will introduce four evaluation methods to help investors avoid the next JPEX.

️ Related reading:

Hong Kong’s biggest financial fraud case! JPEX exchange controversy spreads to Taiwan, Hong Kong lawmakers warn “beware of compensation schemes”

“Centralized Exchanges” and “Decentralized Exchanges”

Cryptocurrency exchanges can be divided into “centralized exchanges” and “decentralized exchanges.” The following will outline the characteristics of these two types of exchanges.

Centralized Exchanges (CEX):

Characteristics:

Similar to traditional banks or securities exchanges, they have a central organization to control and manage transactions, ensuring the execution of all trades and access to funds.

Advantages:

They have a central management entity, user-friendly interfaces, and provide customer service support.

Disadvantages:

As they are operated by specific organizations, there is a risk to user assets if internal issues such as misappropriation or internal theft occur.

Decentralized Exchanges (DEX):

Characteristics:

They do not rely on a central management entity. Transactions are based on blockchain technology, which is open, transparent, and does not require third-party involvement.

Advantages:

Decentralized exchanges do not hold user funds, allowing users to have 100% control over their funds.

Disadvantages:

The user interface may not be as intuitive or user-friendly as centralized exchanges, and there may be a higher entry barrier.

️ Related reading:

Gateway to the Web3 World! What are exchanges and what types exist?

Four Ways to Verify the Security of an Exchange:

Every investor should prioritize the security of their assets. The following will introduce four evaluation methods to help everyone choose a trustworthy “centralized exchange.”

Method 1: Exchange Ranking and Rating Search

Cryptocurrencies are still in a regulatory gray area in most countries, and many small exchanges have encountered difficulties or even disappeared due to a lack of transparency or poor fund management.

To quickly understand the current status of globally renowned centralized exchanges, you can refer to two well-known data platforms: CoinMarketCap and CoinGecko. They provide detailed exchange rankings and ratings.

These ratings range from 0 to 10 and are based on factors such as website traffic, trading volume, currency circulation, number of listed coins, and the authenticity of reported transactions.

Currently, exchanges such as Binance, Coinbase, Kraken, Bybit, and OKX have received higher ratings on these platforms.

Ranking of centralized exchanges on the well-known data platform CoinGecko.

Method 2: Proof of Reserves (PoR)

The significance of Proof of Reserves is to prove that an exchange or other financial custody platform has sufficient funds to fulfill user withdrawal requests and ensure the safety and transparency of user funds.

The core of PoR is to ensure that an exchange’s liabilities (user deposits) match its assets (the amount of tokens held) to reduce the risk of unforeseen circumstances or emergencies.

In 2022, FTX, which was previously a top-ranking exchange, suddenly collapsed because its fund reserves were far from sufficient to meet the massive withdrawal demands from users, leading to the so-called “bank run” phenomenon.

To rebuild market confidence, many well-known exchanges have started taking measures to prove their financial soundness, including implementing Proof of Reserves (PoR). In addition to regularly published reserve audit reports by exchanges, you can also use free tools like Gecko Terminal to check an exchange’s funding status.

Asset data of OKX exchange on the well-known data platform Gecko Terminal.

Proof of Reserves of the well-known exchange Binance.

Method 3: Secure Asset Fund for Users (SAFU)

In the event of unforeseen incidents on a centralized exchange, such as system failures, hacking, or other unexpected factors, established insurance funds serve as a buffer to help users and the exchange itself minimize losses.

For example, Binance established a well-known User Asset Protection Fund in 2018, which is currently valued at a staggering $1 trillion. This fund is stored on the blockchain and can be accessed by users at any time.

In 2019, when Binance suffered a hacker attack and lost 7,000 bitcoins, they quickly activated the SAFU fund to compensate for losses exceeding $40 million, demonstrating their commitment to protecting customer assets.

User Asset Security Fund of the well-known exchange Binance, with a total value of $1 trillion.

Investor Protection Fund of the well-known exchange Bitget, with a total value of $350 million.

Method 4: Possession of Regulatory Licenses

For most users, the possession of regulatory licenses by an exchange is usually a key indicator of trustworthiness. This is because a license represents that the exchange has passed strict scrutiny by a specific country or region and complies with local regulations, ensuring that users’ deposits and withdrawals are conducted within a legal framework.

However, it is important to note that regulatory standards and licenses issued vary across countries.

For example, the United States has the NMLS and MTL financial remittance licenses, the European Union provides licenses for Virtual Asset Service Providers (VASPs), and Japan has licenses for digital currencies issued by the Financial Services Agency (FSA).

In Taiwan, there are no clear regulations specifically for cryptocurrency exchanges yet. To open a cryptocurrency exchange, besides complying with the Anti-Money Laundering Act by establishing customer identity verification (KYC) and transaction monitoring systems (TMS) to prevent money laundering and terrorist financing activities, exchanges also need to apply for an experimental license under the Financial Technology Development and Innovation Experiment Act from the Financial Supervisory Commission.

Proofreading editor: Gao Jingyuan